You're right to worry about your credit. Slip-ups on your credit history today can mean tighter terms on your mortgages, auto loans, student loans and other “big step” financings tomorrow. Like the proverbial broken mirror, a black eye on your credit report will haunt you with seven years (or more) of bad luck. Read: higher interest rates, inflexible payment plans and hobbled buying power. But don't worry too much – it's not as bad as it seems.

While it may seem like your credit rating is a hapless white apron amidst a sea of grubby fingers, just waiting to be randomly and senselessly sullied, the fact of the matter is that there is little that's going to surprise you on your credit report.

Read on to learn about some things that won't affect your credit score:

Soft Pulls

“Congratulations! You're Pre-Approved!” has virtually become the go-to salutation for mail correspondences these days. These unsolicited credit card offers can be nerve-wracking. How do they know about your credit? And what does this mean to your credit score?

You may have heard that credit rating bureaus (Experian, TransUnion and Equifax) keep tabs on who requests your credit info. In fact, these inquiries do indeed show up on your credit report.

Luckily, though, these inquiries are run-of-the-mill and have no effect on your credit score, according to the Federal Trade Commission, which calls these “prescreened” credit offers. The credit card company doesn't single you out because you accidentally signed a release, rather they ask the credit reporting agency to provide a list of people above a certain credit score threshold and fire away. If this bugs you, simply “opt out” of such offers by phone or email.

Inquiries that do not affect your credit score are called “soft pulls.” This is in contrast to “hard pulls,” which do affect your credit score. The general consensus is that a hard pull bumps your score down by five points for 6 months. The rationale behind this is that it will signal to prospective lenders that you are applying for a lot of new accounts, and possibly getting rebuffed.

So who's “hard pulling” your credit report? Phone companies, utilities providers, and of course, banks. However, these institutions should let you know that they are doing so (if not, being asked for your social security number and then being put on a hold is a strong indicator that someone is doing a hard pull on you). Overall, these aren't much to worry about, since your credit score will right itself after 6 months. If you are turning your gas and water off and on, applying for mortgages and changing your cell phone contract over and over within a span of 6 months, then you clearly have something wacky going on anyway.

For a list of institutions that perform hard pulls, check out this list from FatWallet.com.

Authorized Users

This is a recent development as part of the changes enacted in the FICO 08 (ironically released in 2009) formula for computing credit scores. In the past, those with little or bad credit could “piggyback” on the good credit of someone else by becoming an authorized user on their account. This had the effect of boosting the credit of the authorized user while occasionally dragging down the actual cardholder. However, some “credit repair” institutions used the practice to grift the system, by farming out authorized users for kickbacks in order to artificially improve credit scores. FICO 08 puts an end to all that.

As of February 2009, authorized users will not affect your credit score. This can be a good or bad thing, depending on what your situation was before the switch. If you were mooching off the credit kudos of your mom, dad or significant other, you'll likely be dropped back down to your sorry old self. But if you were shouldering the load for someone else, you should enjoy a credit score boost from the change.

Small Potatoes

Another happy revision in the FICO 08 deals with small negative items in your credit history. Before February 2009, a late payment on a $30 parking ticket or a $10 co-pay, or you forgot to forward your mail and a bill got sent to collections, was bad news for your credit score. In a cruel case of the punishment failing to fit the crime, these smudges on your credit history would have a similar affect as a bigger transgression, and would take just as long to fade away. Now, however, FICO 08 allows a bit more leniency. While this doesn't declare open season for delinquent bills, it does let you off the hook a bit in regards to slight oversights during migrant years.

Age, Race, Gender

In the darker days of racism, it was common practice for certain lenders to withhold mortgages from certain socioeconomic classes and ethnicities in order to dictate the makeup of a residential neighborhood. This was called redlining, and it is now illegal. Nowhere on your credit report is an item describing your race or ethnicity, and FICO's formula does not factor age or gender into the final product.

Note, though, that if you are genuinely being discriminated against while applying for a loan, the culprit is the lending institution. While credit scores provide a guideline for assessing risk in lending, it is ultimately the lender's call.

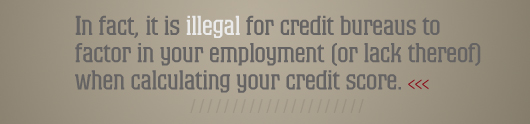

Employment History and Income

While, again, lenders may use information about your employment history and your income in order to determine whether or not they will give you a loan, this information does not play a role in your credit score. True, information about your current and past employers and your address history are included on your credit history. In fact, it is illegal for credit bureaus to factor in your employment (or lack thereof) when calculating your credit score.

Staying on the Up and Up

So if these items don't affect your credit score, then what do you need to do to keep your credit healthy? While there is some nuance to maintaining good credit, there are only a few pointers you need to remember:

- Pay your bills on time, all the time.

- Don't carry a balance, if possible.

- Keep a high credit line to debt ratio.

- Keep an eye on your accounts for possible fraud or identity theft.

In short, use your head and be responsible. If you don't already adhere to the advice above (especially the third bullet), chances are you'll be insolvent soon anyway, making difficulty getting a loan a moot point. For more information on credit scores and credit reports, check out these resources:

- MyFico – Credit Education

- AnnualCreditReport.com – This is the real deal, by the way. Don't bother with the other scams that will trick you into subscribing for costly (and useless) services.

- FTC – Credit Scoring

- The Motley Fool

- The Simple Dollar

- Get Rich Slowly

In the meantime, Don't Buy Stuff You Cannot Afford.