By David Bakke

Saving for retirement is a daunting task to many people. To some, it may seem so far off that it warrants less attention than matters at hand. Others may feel they're starting too late in the game and can achieve little with their efforts. Well, I'm here to tell you that virtually anyone, anytime, can and should begin saving for retirement. Regardless of your knowledge of investing, and whether or not you have significant funds to devote to your savings, you can still make an impact in your future financial situation.

Reasons to Start Saving Now

Eventually, you're going to have to hang it up and leave your career. When you do, you're going to want as much money as possible to enjoy your golden years. If you're starting out late, it doesn't matter why. All that matters is that you get started today.

1. Because No One Else Is Going to Do it For You

Unless you come from a moneyed family and your trust fund is financing your retirement, the responsibility to plan it lies with you alone. You owe it not only to yourself, but to your kids, to effectively save for retirement so you're not a burden once you reach your sunset years.

2. The Magic of Compound Interest

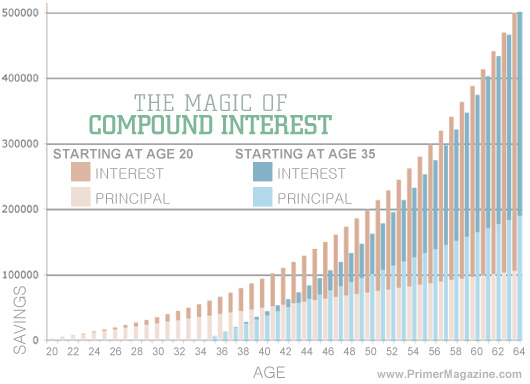

To understand the power of saving for retirement at a young age, you have to understand the concept of compound interest. Supposing you start saving at age 20 and plan on retiring at 65, if your overall goal is $500,000, you'd need to set aside $2,350 each year, based on an annual return of 6%. If you wait until age 35 to begin saving, your yearly contribution nearly triples to $6,325. Whether you're younger or older, start contributing to a retirement fund as soon as possible to maximize your savings potential.

3. The Uncertain Future of Government Programs

Both Medicare and Social Security are struggling, and some experts predict that Social Security may start running out of money by the year 2033, and Medicare by 2026. Don't simply assume these programs are going to be fully available to you in retirement. Prepare for any contingencies now.

How to Do It

Saving for retirement isn't rocket science. It's math. And basic math, at that. Cut your expenses until you have a monthly surplus, and then educate yourself as to the best places to invest.

Follow these five steps to get going:

1. Institute a Personal Budget

Write out all your monthly expenses on one side of a page and your income on the other. If you're currently making more than you're spending, you can devote that surplus to your retirement funds. If not, you need to take a closer look at your expenditures and start making some cuts.

2. Reduce Monthly Bills

Bundle your cable TV, cell phone, and Internet services under a single plan or cut things you don't really use. Look for hidden fees on all your monthly bills, and if you find any, contact the provider to get them eliminated. Switch to the competition whenever you see a better deal (as long as you're not under contract) and pay your bills with a credit card that offers cash back to increase your savings.

3. Save on Grocery Shopping

It may seem passé, but clipping coupons can save you significant money on your groceries. Buy several copies of the Sunday paper to maximize the effect. Organize your coupons in a filing system so you're sure to redeem them before they expire and shop on the days your grocer doubles their value to save even more.

4. Reduce Your Gas Costs

Check out the website GasBuddy to save on your fuel costs. Input your zip code and you can find all the cheapest gas stations in your area. Combine trips to the cleaners, supermarket, and pharmacy on either side of your work commute and you're going to find yourself spending a lot less on fuel. Keep your car properly maintained by following your owner's manual guidelines as well.

5. Prioritize Personal Purchases

Personal purchases fall under one of two categories: needs and wants. And it's easy to distinguish which is which. If you don't absolutely need something to survive, then it's a want, plain and simple. If you apply this distinction to your spending habits, you may find that the majority of your personal purchases are wants. Define the two objectively and hold off on your wants as much as possible.

Final Thoughts

Once you've built up some funds, start off by devoting them to your employer-based 401K program. Choose the highest possible percentage that your budget can afford. If that's not an option, open an IRA. Both the Roth and Traditional IRA have their advantages and disadvantages, so research them thoroughly and decide which option is best for you. Saving for retirement is serious business, and the sooner you get started, the better off you're going to be.

What are you doing to save for retirement?

David Bakke is a contributor for Money Crashers. He shares career advice, tips for personal development and self improvement, and strategies for building wealth and success.