Looks like the economy is finally turning around a little; you’ve landed your first real job since graduating from college a few years ago. Congratulations! You have money for new clothes, a gym membership, and your social life. But with that money comes great responsibility. In other words: Don’t blow it.

If you don’t pay attention to the money that’s coming in vs. the money going out, you may find yourself in a mountain of debt and a home full of possessions you don’t really need or have room for.

Keep your spending in check with these six tips:

#1: Shop the Sales, Intelligently

Primer recently posted a great article about saving boatloads of cash at Banana Republic. Sales are a great way to acquire new clothes that you desperately need. But, adhering to the doctrine of minimalism, if you don’t really need it, don’t buy it. Bringing clothes into your home that are not needed or for which there is no room creates a cluttered environment that is challenging to keep clean and manage.

Sales are great but they should be used for exactly what is needed and no more. Some people are great at hitting up sales just at the right time. Say you need ten summer shirts and it just so happens that they are 50% off that day. Just because they’re 50% off doesn’t mean you should end up with twenty shirts. Why? You’ve just invalidated the sale. You only save money by shopping the sale for exactly what you went in planning to buy and no more.

The purpose of a sale is to spend less on what you need. Spending more? Great for the store, not so great for your wallet.

#2: Cash is King

The best way to monitor what goes in and out of your wallet is to use cash. Nowadays, our credit card bills are online. Point, click, and pay. Do you even look at your statement? You might not recall your purchases thus you have no idea what you’ve spent.

By switching to cash, you can see your money dwindle away. It can be jarring to start the month with a thousand dollars in cash and watch it disappear. At month’s end, ask yourself what you spent that money on. Groceries, gas, sour cream and onion Pringles? When your pile of cash shrinks, you realize you don’t have enough for excessive items.

Obviously you won’t cram an envelope full of cash and mail it off to your cable provider. And you won’t hand your landlord a brick of money mafia-style for the rent. But when you can pay cash, you should. It’s a smart way to manage your money.

#3: Groceries

I noticed my Whole Foods bills were high. Odd, because I don’t buy what I don’t need, and I almost never waste food. But I do spend a lot in this category. So I’ve implemented two strategies: Before I get in line to pay, I look at the items in my cart to see if there’s anything I grabbed on a whim. I put it back. Second, I now limit my spending to a certain dollar figure.

I was spending $100 a week on groceries ($5,200 a year). To become a more discriminating shopper, I came up with the $80 Whole Foods Challenge. Could I buy everything I need to last one week and reduce my spending by $20?

So what do you do with the extra $80 at the end of the month? Some might say: “Spend it on something else!” I say that invalidates the purpose of this article.

Spending is out of control. Especially at the grocery store. Did you know Americans waste 40% of the food they buy? That’s shocking and unfortunate, especially when you consider that in 2010, almost one billion people went starving.

In Europe and major U.S. cities, folks stop by the grocery store several nights a week on their way home from work. This means people buy only what they want that day, which can curb excessive ‘forecast’ spending. If you can’t pass by a grocery store frequently, create a menu for the week and pledge to stick to those items.

A lot of people see a twenty-dollar bill as one insignificant twenty. What can you do with that? Not much, really. Can’t buy tickets to WWE Monday Night RAW or an iPad. But with some simple arithmetic, that twenty adds up. Saving $20 a week at Whole Foods turns into $80 a month or $960 a year. And that’s just at the grocery store!

#4: Make a Budget

Do this: Collect the receipts for every purchase you make over the next month. Don’t cheat or suddenly become budget conscious. Spend your money the way you always spend your money. Ask for a receipt when you buy a bag of Skittles and a bottle of water (I recommend the sour Skittles). At the end of the month, tally every dollar spent (excluding the necessities like rent, car insurance, etc.) and assess the damage.

Can you cut back on anything? Of course you can. Do you get one DVD at a time from Netflix? I do, too. Does Chernobyl Diaries sit on your coffee table for three months like it does in my house? Do you keep telling yourself you’ll watch it this weekend? Keep telling yourself that. Meanwhile, you’re spending $54 over the course of three months when you could have cut down to streaming service and paid $24 instead. Or, dare I ask—could you cancel your Netflix subscription?

If you’re an out of control spender, ask a trusted friend to review your budget. By collecting receipts for a month, you can figure out what spending is necessary and what is not. Looks like you go to Chipotle a lot. Can you eliminate it? … Probably not. But can you reduce your visits?

I used to get excited about new purchases. Even the stupidest stuff got me going. New toothpaste? I’d come home, rip open the box and use it right away even though I still had a half full (optimist!) tube on the counter.

Buying new things makes you feel good. I get it. It’s a new shiny toy. And toys are awesome. We get in a routine. Maybe we hate our life or our job or whatever, so buying things gives us a lift. There are a few problems with this:

- The rush wears off, encouraging more spending to keep the high going.

- It masks the real issue and suppresses your resolve to deal with whatever is getting you down.

- Excessive purchasing results in excessive clutter. Next thing you know, you’re renting a storage room for all the junk you never used in the first place.

Train yourself to achieve the same euphoria by saving money that you experienced while spending money. Challenging, but possible. And here’s the kicker, when you curb your spending, you find that you have more time to do things like cooking a healthy meal or enjoying leisurely walks on the beach.

There’s another perk: Since you now only buy what you really need, each item feels just a little bit more special.

For those of you who have hit financial rock bottom, realizing you’ve got no money and a house full of junk can be frightening.

My favorite Joe Biden story is when his father sat him down and said, “Son, don’t tell me what you value. Show me your budget and I’ll tell you what you value.”

#5: Four Things to Think About

1. Don’t adopt the dreaded It’s Cheap so I Should Buy A Lot trap. As my girlfriend says when we have a cheat meal at Taco Bell, “You can always order more later.” My eyes are bigger than my stomach. The same principle stands for shopping. Buy just what you need. If you used to buy books, and now you buy e-books, be happy that you’re saving money. Like the shirts, you’re not saving money if you buy double the amount of e-books.

2. I do laundry once a week. Two loads = one hour. Every so often, I see a guy drag in seven loads of laundry. There are only a finite amount of washing machines, so he ends up doing laundry the entire day. He thinks he’s smart by buying thirty boxers and socks and two-dozen shirts. But he’s actually shooting himself in the foot. Postponing something simple, like laundry, means it becomes something laborious. Like LAUNDRY!!!

My spine shivers at the thought of folding and putting all those clothes away. Will he devote all the time to that? No. He’ll just cram his clothes back in his laundry bag, where they will live until the bags are empty and piles of dirty clothes become his shag rug. Clean clothes will be wrinkled; he’ll look like a slob. As every grandpa in the world has said throughout the course of history: “Own a few things and take really good care of them.”

3. When you don’t blow your money on every little thing, you will have more for special things. If you drink a milkshake several times a week, their delicious novelty wears off. But it becomes a special occasion if you limit yourself to one a month (and you’ll have Mayor Bloomberg’s approval).

4. Stick with what you know. I bought some stuff for my hair several years ago. It was expensive, but I loved it. The bargain hunter in me kept looking for a cheaper alternative, hoping to save money. Instead, I wasted my money on subpar hair products. Sometimes, you can justify these expenses. As my second grade teacher, Ms. Goldberg, used to say, “A little bit goes a long way.”

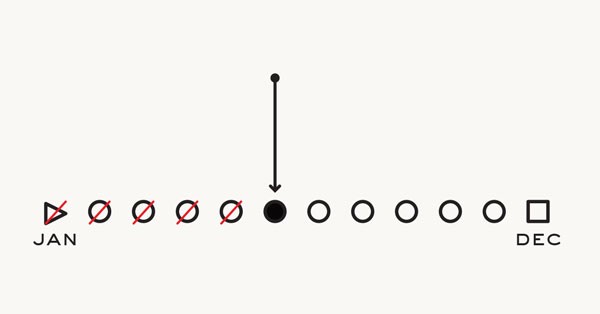

#6: Save!

So, what’s the point in saving this money? Well, it’s two fold:

One, your job might not be as stable as you think. You need to have a nest egg of several thousand dollars put aside for emergencies, etc. Saving is impossible when you’re throwing $20 here and $20 there on unnecessary purchases.

Two, it’s just plain smart. We’re living a lot longer these days. I know, I know. Primer is for young men. But it’s also for smart men. And smart men save and plan for retirement, even in their 20s.

The retirement age used to be sixty, giving people an extra ten years to goof around and watch Murder, She Wrote reruns. But thanks to science, we’re living a lot longer these days. If you still aim to retire at sixty, you need to have enough money to make it to 90.

You won’t make it past 65 if you don’t curb your spending habits.

And it’s not just about saving money. It’s also about accumulating less stuff over a lifetime, having fewer (or no) storage bins. If we can learn to live with fewer possessions, we can enjoy a more manageable, less hectic, less broke lifestyle.