You are now in the workforce and have a decent job with good benefits including a 401(k) plan. For someone in their 20's, 401(k) money is a glimpse into your future 40 years from now. Trying to decide what to do with money with a 40-year horizon is a bit daunting. Think of 40 years back in 1973 – cars all had V-8 engines, gasoline was full of lead, there were three TV channels in most homes coming in by antenna and advanced calculations were done with slide rules.

To not try to guess what will happen over the next 40 years, you need a shorter-term plan to allocate your 401(k) savings. The goal is to have a portion of your 401(k) money in different asset classes which should each have their day – or decade – of above average performance. The scenario you want to avoid is to have most of your money in one type of investment, then have that investment do really, really well – until you start to believe in your own investment picking genius – to be followed with that investment going into the tank.

And all hot investment classes – stocks, bonds, real estate, gold and collectibles – eventually have their bubble burst with serious drops in value. These assets eventually come back, but it is not a good thing to have half of your retirement account disappear and then have to start building it up again.

Asset Classes

Before discussing some allocation strategies, let us take a look at some of the asset classes you would like to have in your 401(k) plan. What you can do depends on the investments offered by your employer, but most plans offer a range of mutual funds. As the world of financial products continues to change, your 401(k) may eventually offer ETFs (exchange-traded funds) as well as mutual funds.

Look through the fund offerings of your 401(k) plan and make a note if you have access to any of the following types of funds:

- High-Yield Bond Fund – High-yield bonds are corporate bonds from companies with less than investment grade credit ratings. Besides paying attractive yields, the market values of these bonds cycle with the economy. When the economy gets bad, high yield bonds generally get cheap and increase in value as things improve. For someone in their early working years, high-yield bonds are a better investment choice than other types of bond funds.

- Real Estate Fund – Real Estate Investment Trusts – REITs – are publicly traded companies which own commercial real estate such as office buildings, shopping centers, storage units and industrial commercial properties. A real estate focused mutual fund will hold a portfolio of REIT stocks and other related companies.

- Natural Resources Fund – It would be great to own a gold bullion ETF in your 401(k). However, most plans do not include ETFs, so the next best thing will be a mutual fund focused on natural resources stocks. This type of fund will own companies which earn profits from natural resources such as mining companies, oil companies and timber companies.

- Emerging Markets Fund – The emerging market economies are predicted to grow twice as fast as the developed economies of North America and Europe. Emerging market funds will provide a wild ride, but the long term results should be way above average.

Allocating Your 401(k) Assets

Along with the four types of funds discussed above, you should pick out one or two domestic stock funds from the list available in your 401(k). As a result you will have five or six funds into which your contributions will be credited. Initially, divide any existing 401(k) account balance and your future contributions equally into the selected funds. It is impossible to guess which asset class will outperform over the next several years, so an even allocation makes as much sense as anything else.

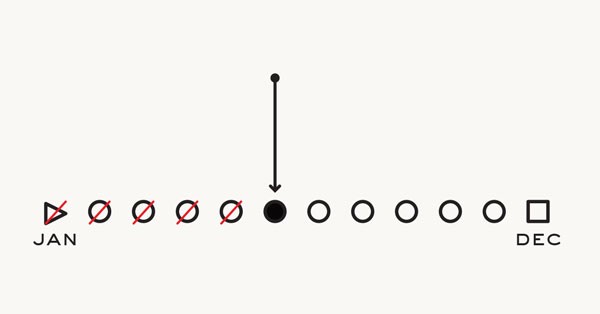

Let your 401(k) assets build in value for a couple of years and then start to re-balance back to your original allocation every 6 months or annually. Many 401(k) plan administrators let you set up automatic re-balancing. Take advantage of this feature if you have it available. It will take a while – possibly several years – before true performance differences start to show. The best course of action at this point is no action. Let the funds and asset classes work through the natural short term swings and allow the longer term trends to build value in your retirement account.

A final word: If you can buy company stock in your 401(k), limit the allocation to no more than 10% of you retirement account value. Your company may be the greatest thing since the iPhone, but the fortunes of a single company can change rapidly. Your 401(k) is a 40-year work in progress. Always keep that fact in mind.

Of course, everyone's situation is a bit different, so check with a financial planner before making changes.