OK. You've finished college. You've got a great job. Your apartment is great, your girlfriend would do anything for you. You can't help but see life through rose colored glasses. So why worry about retirement? Well, the whole point is you don't have to. Not if you can discipline yourself enough to plan ahead. What do you do? You start investing in your company's 401(k) plan.

Essentially, a 401(k) is a salary reduction plan where you decide what percentage of your salary to contribute, and where the plan spells out how much your employer will contribute on your behalf (although not all employers will match you). Your taxable salary will be reduced by the amount of your contribution, the amount is invested, and any money you earn from the investments you make are tax-deferred until you take your money out at retirement. If you take money out before that, you will end up getting penalized for the early withdrawal, much like a Certificate of Deposit at your local bank.

Why save?

First off, no one knows what Social Security is going to look like by the time you hit 65. Second, a 401(k) is one of the best ways to save for your retirement, unless you know who wins the Superbowl in 2012, so your money is safest in the hands of a capable investor and in a good fund. Third, and quite possibly the best reason, if your company is like many, they're probably going to give you money for participating in their 401(k). That's right, if you invest in your company's 401(k), they will probably give you money.

Investment Types

Now, to the sort of difficult part. If you're new to balancing your checkbook and other fun stuff like that, the choices a typical plan offers for you to invest in can be daunting. And of course, your employer is already giving you free money, they're not about to shell out the bucks to get you a financial manager too, so you're going to have to pick your investments yourself. The typical things on offer are likely going to include money market funds, stable value accounts, bond mutual funds and stock mutual funds.

Money market funds and stable value accounts are low risk. That means that they also don't make much money–professional investors make money by ‘timing' price fluctuations–the bigger the fluctuations, the more money can be made, and these accounts don't do that kind of gyrating. Hey, if you want high risk, move to New York or L.A. Most of the time, these two vehicles consist of certificates of deposit (CD's) or U.S. Treasury securities. You'll get roughly 4 or 5% back on these, maybe less–but you aren't likely to lose your retirement money either.

Bond mutual funds are pooled amounts of money invested in bonds. When you buy a bond (or lots of bonds) you are basically lending money to the issuer of the bond. Most of the time, you'll get regular interest payments until the money is returned–and in some plans, you can choose to reinvest these. It's usually the case that the money you're paid is a fixed percentage of the amount you invested, and is why these neat little things are called “fixed-income” investments. The Return on Investment (ROI) on these ranges from 4%-8% a year, but the risk is slightly higher than, say, a money market fund.

The last on our list are stock or equity mutual funds: these funds are essentially part ownership in corporations that publicly trade their stocks. These can be great vehicles if you're starting out, since you'll typically be able to absorb more risk while you're younger than if you're closer to retirement. So, if your company invests in other companies that do well, so will you. If they spend your money on bad investments (think Enron), do it now, while you're younger and can take the hit.Of course, each plan is different, and your employer may offer more or less than the four types of funds or investments that I've listed here.

A Portable Investment

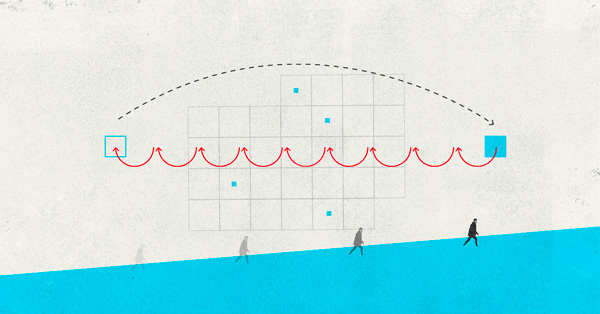

Still, the neatest thing about 401(k)'s is that they're portable. I know, you must be thinking “It's a bank account. How the hell is that portable?” What I mean to say is that if you change jobs, and more and more people are doing just that, the account can be “rolled over.” So, if you leave the company, your account can be moved into an IRA account at almost any independent financial institution, or with your new employer's fund, if they have one.

There's a lot more to retirement investements than can fit in one article, so next time we'll look at how investors pick their stocks and bonds. Sound simple? Sound like I'm aiming too low? It isn't. Most actively managed mutual funds lose to market averages when considered over time. Sure, many of the funds do beat the average market return once in a while, but that's typically for only a very short period of time, and then quickly return to normal. Now, giving you advice on picking the right stocks is something that under U.S. law only a licensed broker can do. There's a reason for this, so if you decide to take your own advice, do the legwork first. In an upcoming article I'll tell you where you can start your studying–but I won't tell you what stocks to pick–that's a no-no, remember?

![It’s Time to Begin Again: 3 Uncomfortable Frameworks That Will Make Your New Year More Meaningful [Audio Essay + Article]](https://www.primermagazine.com/wp-content/uploads/2025/01/begin_again_feature.jpg)