In High School you counted down the days to getting your driver’s license. You wanted freedom from uncomfortable and mind-numbingly slow moving school buses and having to plan your day-to-day activities around your parents’ availability and mood.

Once your dad handed you the keys to his old busted-out pickup truck you were on cloud nine. Finally you were free! It didn’t matter that the car had a chunk of it literally rusting away and inside it smelled like cigarettes and stale farts, you were FREE, dammit! Dating, working, EVERYTHING became possible for you now because you could get from A to B all on your own.

When you went to college you knew going in that the college experience didn’t really necessitate a car; busses, subways and taxis always ran, and your friends and most of the fun activities were within walking distance anyway. Hell, if you were REALLY smart (and didn’t mind just a little ridicule) you brought your bicycle with you and you HAD IT MADE. Pedestrian life was not only acceptable, it was standard issue. Besides, that rusted old pickup likely wouldn’t have even made the trek to campus, let alone back home.

Once you graduated and got back from college, you obviously couldn’t afford a new car of your own, so you dusted off the old pickup truck and worked your butt off to get a job. The pickup wasn’t impressive, but it got you from A to B.

Now, you’ve got a decent paying job that allows you to retire the old pickup truck and buy the new hotness. Deciding to buy a car is the easy part; deciding WHICH car to buy, well that’s an issue entirely unto itself. The choice can be daunting, but here are some ideas and tips to help make sure that the car you buy is the right one.

The Investment

The first thing you must understand is that, monetarily speaking, a new car – no matter how nice, no matter how expensive, no matter how well you take care of it, or what kind of upgrades you put on it – will NEVER be a good investment. It will never be worth what it’s worth when you buy it. Accept that. A brand new Cadillac will have lost you thousands as soon as it’s driven off the car lot, and that’s true across the board.

Some cars devalue slower than others. Jeeps and Corvettes are known for having comparatively excellent devaluation rates because, frankly, they’re widely considered to be the very best at what they are meant for, and never go out of style (or demand). A Jeep never looks old, only rugged. A ‘Vette never looks old, only classic. Even in rare situations like these, you should not ever expect your car to MAKE you any money as an investment.

What’s Equity?

I’m consistently surprised how many educated people around my age have no idea how vehicle equity works, so it merits a quick mention. Sometimes your monthly payments catch up to, and surpass the devaluation rate of your car. The equation is simple enough:

(Current Vehicle Value) – (Current Purchase Balance) = Equity

If the value of your car is higher than what you owe on it, what you have left is your car’s equity. In a trade-in setting, this can be used to enhance (or in lieu of) a down payment. Equity is your friend, and you will usually have it within the first 3 years of owning a car, IF you keep up with your payments and didn’t choose the longest available financing term.

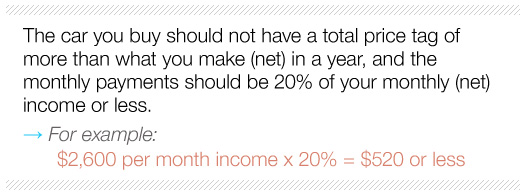

The Budget

Before you begin your car hunt you MUST decide how much you are willing to spend. Seriously, set a HARD ceiling for total cost of the vehicle, monthly payment, AND length of your commitment BEFORE YOU EVEN APPROACH A DEALERSHIP. (Salesmen will ALWAYS try to up-sell you. That is what they do.) Generally speaking, the car you buy should not have a total price tag of more than what you make (net) in a year, and the monthly payments should be 20% of your monthly (net) income or less. This equation makes sense if you consider that most cars are financed for around 5 years.

To be really sure, for a couple of months before you buy your car (YES, this is a BIG purchase, and you should think about it for a WHILE), start saving the amount you set as your monthly payment ceiling. Are you able to still save 10% of your monthly income in spite of the extra bill? After you make your down payment, can your emergency nest egg still take care of you for a few months, should the worst happen at work? Are you comfortable with being committed to paying this payment for X amount of years?” If the answer to these questions is a comfortable “Yes,” then it’s time to figure out exactly what kind of purchase you plan on making.

The list is far too long and personal tastes far too subjective for me to sit down and write about exactly what make and model of car you should buy, or whether a luxury vehicle, an SUV, or an economic sedan etc. is right for you. Besides, you already KNOW what kind of car you want, and what you’re willing to spend.

It’s more important to think about whether or not you want…

The New Car

PROS: Reliability. Full warranty. Very flexible finance terms. Lease option. That “New Car Smell.”

CONS: Significantly higher priced. Immediate devaluation. Longer-term investment. Higher Insurance rates.

Other realities of buying a new car, though, are less encouraging. First and foremost; your car, the second you drive it off the lot, will drop in value substantially (likely $3,000-$6,000) and that is money that you ABSOLUTELY won’t get back, no matter what. Even if you drive off the lot, and IMMEDIATELY change your mind and reverse right back into the lot, you have LOST thousands.

Another expensive reality is that, while your car is being financed, you MUST have full-coverage insurance on it, which is much pricier than basic liability insurance (this is especially true for those of us who are under 25 and single). The company that you are financing through will insist on it, and you will be contractually obligated. Now, full coverage insurance is generally a good idea anyway, if your car is worth $10,000 or more. If you are not used to spending that much on insurance you need to make sure to factor that in to the total monthly cost of you vehicle, which may affect what you can afford.

Buying vs. Leasing

The debates swirl round and round as to whether it is a better idea to BUY or LEASE your new car. Leasing allows for a lower monthly payment, and makes vehicle devaluation and interest rates relative non-issues. Buying gives you equity, virtually unlimited annual mileage, and if you really like the car and choose to keep it, maybe a few years WITHOUT a payment (take it from me: that rocks).

Which is the better investment? I could go on and on, but Occam’s Razor here is that if you are the type of man who will want a new car every couple of years, leasing is likely for you. If you are the type of man who will want to hold on to a good car for years, buying is more suited to you. Simple as that.

The Private-Seller Used Car

PROS: Most affordable option. No immediate loss of value.

CONS: Little or no remaining warranty. Limited seller accountability. Higher cost of maintenance. Generally less reliable.

You’ve been browsing Craigslist, Autotrader, and Ebay for weeks, and you found a car that looks pretty good! And MAN that price is attractive! Maybe you could even buy it CASH?

Yes, this is by far the most affordable option. Many times a seller just wants a new car and wasn’t happy with what the dealership offered them for a trade-in, so he’s trying to make up the difference by selling it privately. Sometimes, though, the seller is trying to sell you something he knows is a piece of crap. This is one of those heavy BUYERS BEWARE situations where there’s no warranty, no contract, and no accountability.

It’s your call to determine whether or not this is car is a real find or a piece of crap, and to be honest, I’ve seen both happen several times. These kinds of deals can be especially good if you or someone you know is well-versed in auto mechanics.

ALWAYS get a vehicle history report. ALWAYS have a trusted mechanic look at it. ALWAYS test drive at least twice. ALWAYS compare the asking price to the Blue Book value. NEVER pay blue book value or higher.

Certified Pre-Owned (C.P.O.)

PROS: Significantly less expensive than buying new. Usually still under warranty. Minimal immediate loss of value. Flexible finance terms. Builds equity VERY quickly.

CONS: Limited selection. Some potential for a “lemon” purchase. Possible high mileage. Usually slightly higher interest rates than buying new.

Monetarily speaking, buying a certified pre-owned (also called program used) vehicle from a certified dealer is, by far, the BEST VALUE of the three options. If you’re uncertain about what exactly a certified pre-owned vehicle is, have a look at the section of used cars off to the side at a new car dealership. Most of those can be classified as C.P.O. These vehicles have been thoroughly inspected by OEM mechanics and have been brought as close to “like new” condition as possible.

The cars you find there will usually be recent model, still under manufacturer’s warranty, and will cost A LOT less than buying new. Make no mistake, you are still buying a used car, and you may encounter some of the same problems you would have had you opted for the cheaper private-seller option, but it’s much less likely. Assuming you choose one with a warranty, you have some accountability from the dealership if something DOES go wrong.

If a month into owning your car, you discover that its transmission really needs replacing, the dealership will have to take care of it (once again, the warranty is your friend).

Another thing to keep in mind is that a certified pre-owned car will not have such a severe a drop in value as soon as you drive it off the lot as a new car would. This coupled with the vehicle being cheaper than its new counterpart means that you will be able to build equity MUCH sooner than you would have with buying new.

»TIP – If the dealer offers to extend your warranty, GO FOR IT. It will not increase the cost of your vehicle significantly, and will give you years of peace of mind.

Quick Tips

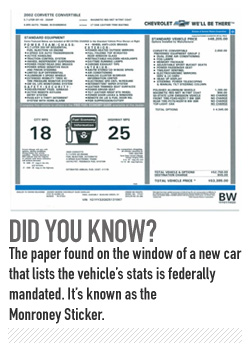

- A vehicles sticker price is NEVER its final cost. YOU CAN ALWAYS HAGGLE as much as $2,000-3,000 off a new car's sticker price. If you really don’t want to haggle (c’mon, are we MEN?), No-Haggle dealerships do exist. If you WANT to haggle, but aren’t good at it, bring a friend who IS and have him/her help.

- Remember, a car salesman wishes to separate you from a large amount of your money, so come prepared mentally.

- Walking away, and even just the indication that you MIGHT walk away, is a VERY powerful haggling tool. The dealer will ask: “What do I need to do to get you in your car today?” Always tell them terms that are BETTER than what you really would go for. They will usually try to meet you in the middle, which can land you right where you wanted to be.

- Always remember: a car salesman is a human being, too. Never let them forget: You are NOT stupid.

- If buying used, a vehicle history report is MANDATE. If buying used from a dealer, they can offer it to you for free (They’ll make it sound like a special favor. It’s not.)

- Don’t drink the free coffee they offer. Being “caffed out” can impede your ability to avoid rash decisions.

- The best time of year to buy a new car is late summer into early fall. This will be around the time that the dealership gets its inventory of vehicles for the next year, and they will need to clear out as much of their current inventory as they can. This means lower sticker prices (which can STILL be haggled down.)

- The best time of month to buy a car (new or used) from a dealership is the LAST WEEK of the month. Every car salesman has a sales quota to meet every month or quarter, and if they haven’t met it yet, catching them at the end of the month will make them more inclined to really work with you at reducing the price. They NEED to sell the car; you DON’T need to buy it. Remember that.