Editor's Note: As always, you should seek the advice of a professional financial planner before making any decisions about your finances or investing. Richard is not a registered financial adviser, and he offers this based only on his personal experience. What works for him, may not be right for you. This should only be used as a basic introduction, and a leaping off point for further research. Read more here.

I’ve heard of a Traditional IRA too … what’s the difference?

The Traditional IRA has been around since 1975 and has a bit more history behind it. Not to be confused with the Roth, the Traditional has the same base concepts of saving and investing money for retirement, but the way the government looks at it is completely different. First of all, in most cases with the Traditional IRA, the contributions you make are tax-deductible with your individual return each year. That’s a huge benefit.

At the same time, the Roth has that benefit when you take money out after retirement in that it is tax free. A huge negative (in this writer’s opinion) is that when you withdrawal money from the Traditional account, it is taxed as gross income. The basic difference is when you are taxed, but the long and short of it is that most people, especially young adults should look more at the Roth than the Traditional. Here’s why…

Background

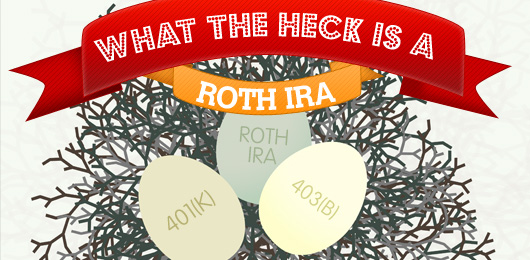

The Roth IRA is an “Individual Retirement Arrangement” which was created by the late Senator William Roth of Delaware back in 1997. These accounts are designed to allow investors purchasing options into securities, common stocks and mutual funds (although other investments can include derivatives, notes, certificates of deposit, and real estate).

Basics

The basic premise behind the Roth IRA is that it is an easy way to build retirement money, tax-free. (Disclaimer: I have had various and multiple Roth IRA accounts since 2002.) Unlike a 401(k), which is a company sponsored account where you invest money pre-tax, meaning your company takes the money before you even see it, the Roth on the other hand is money that you get (or have) and you decide to invest it on your own, therefore it has already been taxed. So when you retire, you get the money tax-free. You can have both types of accounts. If your employer offers a 401(k) and does matching, take advantage of it! It’s free money!

There is a contribution limit which has steadily risen. It was $2,000 in 1998 and is now at $5,000 per year. In fact, in calendar year 2010, you can backdate your Roth contributions until April 15, 2011. That means you can still invest money until Tax Day 2011 to count towards your 2010 limit.

You can create a Roth at any investment firm, big or small. In fact, many banks have been getting into the game over the last few years simply because it is an easy market to get into. Most investments held in the mutual fund are purchased for the long-term so there isn’t a lot of “day-trading” going on and thus, is more of a hands-off investment tool. But that’s not to say that your investments aren’t managed. Any mutual fund you buy is managed on a day-to-day basis, but not by you, by managers.

So, is it good for me or not?

Advantages:

- You can withdrawal money (your principal investment) at any time, tax-free!

- You don't have to start taking distributions just because you reach a certain age. (Unlike the Traditional IRA.)

- You can have this account event if you buy stocks or have a 401(k).

- Because of the crappy Social Security Survivor Benefit situation, the Roth on the other hand is passed on 100 percent.

- If you pass a “five-year ownership test” and are 59 ½, you can withdrawal your earnings tax-free! Read more about this at The Motley Fool.

Disadvantages:

- Once you reach a certain income level, you can’t contribute to a Roth.

- No tax savings just for investing (whereas traditional IRA contributions get tax form deductions).

- Because Roth’s are still relatively new, Congress will probably continue to mess with the rules, so there is some volatility in these investments.

- You may outlive your Roth, which means you won’t see much of the tax-free benefit.

All in all, a Roth is a great starting point. My financial advisor said to me last year, that until you have at least $10,000 to play around with, you shouldn’t be buying pure stocks. If you don’t have any investments, or would like to branch out from your work supported 401(k), the Roth is a great place to start.

As Richard mentioned, the rules for the Roth IRA may change. Be sure to research further and speak with a financial adviser before making your decision.

![It’s Time to Begin Again: 3 Uncomfortable Frameworks That Will Make Your New Year More Meaningful [Audio Essay + Article]](https://www.primermagazine.com/wp-content/uploads/2025/01/begin_again_feature.jpg)