I'm consistently amazed at the sophisticated systems that guys cook up for their MP3 collections – setting up their iTunes to automatically tag, rate and sort their files, beaming their tastes and “now playing” lists to phones and websites across the globe, meticulously compiling mixes for every occasion (“making pancakes mix,” “layoff blues,” “breakup tracks 3.0”).

But in spite of so much fastidious attention to detail and technical savvy, few folks take the time to digitally rig their finances, too. It's understandable, I suppose – dollars and cents aren't quite as exciting as rockin' jams. But the minimal amount of trouble is well worth the payoff: a well-organized personal portfolio and perhaps some extra jingle in your pocket to boot.

Let's start simple.

Open an Online Checking and Savings Account

First off, I know what you're thinking: “There's no way that putting your money in an online bank is secure! What about hackers? Who do I talk to if I have a problem?” But seriously, relax. Think about your ol' brick-and-mortar bank and how “secure” that isn't. Think about all the times you've written your account number on a deposit slip and tossed it into a trash can. Hackers are just as liable to get their grubby Dorito-stained hands into your cash as in-the-flesh bank robbers, and in either case, your money is FDIC insured.

As for customer service, most tellers aren't equipped to answer your more complex concerns as it is (and will usually refer you to a manager or hotline). All digital customer service works for many sectors – Google, for example, doesn't even have telephone support for their mail, document and webhosting services. When a system is hardwired for handling issues quickly and efficiently by phone or email, they tend to execute quite well.

So put those fears aside and let's focus on the perks. The biggest of which is much higher interest rates. When I signed up for my ING Direct account, savings accounts had an interest rate over 3 percent, whereas my old bank didn't even have CDs that high (my savings account was yielding less than 1 percent in interest). Granted, this was before the nation realized that we were essentially bankrupt, sending interest rates plummeting, but even today, interest rates remain competitive at online banks. By moving my savings to ING, I'm already increasing my accumulated interest by 300 percent.

The next best perk is convenience. If you haven't already, set up your paycheck for direct deposit. Then set up your bills (gas, electric, water) to autopay from your checking account (this varies depending on your provider, but unless you live in the 20th century, they should be able to set this up for you). For the rest, use online bill pay. ING Direct allows you to write “paper checks” to any business or individual and they'll stamp it and mail it out for you and you don't even have to lick an envelope or get off your duff. And there you go: all your checks are deposited and your bills are paid and you didn't have to wait in a single line.

ING Direct (review) is the one I chose, perhaps on a whim, but more likely because I dig the color orange. There are a couple other trusted names to choose from, such as: HSBC Direct, FNBO Direct, Emigrant Direct and eTrade. Compare them yourself and decide.

But what about that birthday check from Uncle Jim or that wad of cash from underneath your mattress? How do you deposit that? Simple. Keep your old brick-and-mortar account open and use it as a conduit to your digital piggybank. Deposit the rare paper check there and then beam it from that account to your online account. Otherwise, you can mail checks into ING Direct (others allow you to scan checks in, but this seems wacky even to me) but it's far more reliable to simply link your two accounts and transfer money that way. Plus, your bank teller won't get as lonely.

Hedge Against Falling Interest Rates with a CD Ladder

Regarding the aforementioned stumble in interest rates, there is another handy feature that you can do with any decent bank account. Since I signed up for my Electric Orange Savings with ING, my interest rate has been decapitated from 3 percent to just over 1 percent (thanks, Wall Street!). But luckily, I took a portion of my money and sacked it away in some CDs. You probably already know this, but CDs lock in the interest rate for a certain amount of time – but there is a penalty for withdrawing your money early. So, you are essentially faced with a dilemma: let your savings piddle away as interest rates drop or tie up your liquid capital in a CD, leaving your high and dry in case of emergency.

CD ladders strive to give you the best of both worlds. Here's what I did:

Let's say I started with $30,000 in my savings (theoretically – I won't reveal how much I actually have, in order to prevent undue pity or requests for loans). I have about $5,000 I'm comfortable tying up for the next few years, so I open up:

- A $2,000 6 month CD at 3.5 percent

- A $1,000 9 month CD at 3.75 percent

- A $1,000 12 month CD at 4.25 percent

- A $1,000 18 month CD at 4.25 percent

That way, I'm guaranteed pretty tidy interest rates for 18 months. As you can see, the longer you let the bank hang on to your money, the higher the interest rate is. If I need money, I'll have the option of pulling it out every 3 to 6 months, and if I'm not ready to spend, I can just dump it into another CD.

This was, admittedly, a rather conservative example, but you can go higher up and farther out if you want to. ING Direct (sorry to keep name dropping them, this isn't a commercial, just what I use) has a handy tool for creating CD ladders, as do most other online banks, I imagine.

Track Your Finances Online

In high school, I had this three week course in “consumer life skills” or something, where they taught us how to balance a check book and fill out deposit slips. I also remember my mom painstakingly scribing each minuscule transaction into her little ledger, all the while advising that I had better get used to doing the same, otherwise I'd end up broke, homeless and probably ugly, too. (Okay, she didn't say that. My mother is a kind woman.) In spite of all that, I have yet to record a single transaction by hand, thanks to online personal finance tools. And I haven't missed a beat yet.

Personally, I use Mint.com. Mint.com pulls together all the data from your credit card, checking account, savings account,

401(K), IRA, student loans, car loans and other online accounts into a single “big picture” record. Understandably, a lot of people are leery of a system like this, as you have, potentially, opened up yourself to that many more avenues for identity fraud and security breaches. That's a risk you'll have to weigh out on your own, though.

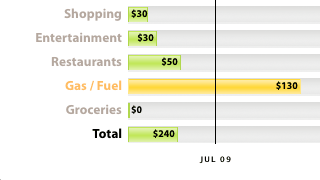

What I love about Mint.com are the charts that it provides. Rather than going through one by one and categorizing my spending, Mint.com guesses (with surprising accuracy) at the type of expense and throws it all up in a pie chart for me to see. The charts are very revealing – it's hard to gauge how you are squandering your money on a daily basis. It can be a shameful wakeup call to discover that you've spent $50 on McDonald's in one week. To catch this kind of corpulent behavior, you can set up budgets and alerts that will notify you by email when you seem to be “Lovin' It” a bit too much.

I also regularly peruse my Mint.com statement for suspicious items. True, you can do this with your normal credit card statement, but Mint.com lets me view all of my separate accounts in one fell swoop. More than once, I've called in my credit card company or a merchant to dispute an overcharge – and it's paid off.

You may find one particular feature of Mint.com (and other such online aggregators) either helpful or annoying: “money saving” suggestions. Mint.com pays the bills by pushing other services or credit card offers that can, theoretically, save you money if you switch. While I appreciate their need to turn a profit, I'd advise against hopping from bank to bank and credit card to credit card in order to chase that $145 or so odd dollars you could potentially be saving per year.

Again, I don't mean to give Mint.com undue attention – it's just what I use. There are other options, such as Thrive, Wesabe.com and Quicken Online. For the security risk averse, you can also just use a Google Spreadsheet or GnuCash or CashBox or some other similar local solution – but you'll be punching those numbers in by hand.

Microfinance: Become a Lender

There is a growing trend called “microfinance” that I haven't yet formed an opinion on. But you may want to consider it. Here's the concept: you lend money to individuals at much higher interest rates than you would get if you plunked your money in a CD or high yield savings account, but at much lower rates than they would get if they got a personal loan. It's called “peer-to-peer lending” and everybody wins, in theory.

It's a very touching model – you get to read about the person you are lending to, learn their story, judge their reliability and hopefully help make their dreams come true in a direct fashion. But you also absorb the risk if they default. But a more troubling scenario is that the institution will run afoul, such as the situation with Prosper.com getting shutdown by the SEC.

Some microfinanciers stress the “help the impoverished” angle even more, such as MicroPlace and Kiva.org, by allowing you to finance entrepreneurs in developing nations. In theory, it all sounds very nice and heartwarming, but the logistics of getting your money to the right hands is a bit baffling to me, and there are a lot of differences amongst the competition. For example, MicroPlace, a subsidiary of eBay is technically a broker-dealer, while Kiva.org is an actual nonprofit. If that means something to you, you'll understand the potential conflicts and complications. And if it's all Greek to you, you're probably in the same boat as me – undecided and apprehensive. [Update: thanks to commenter James for pointing out that Kiva acts as a charity for lenders; you get the same amount back as you invested.]

I think the parts in this scheme are more prudent than the whole. I am a proponent of turning a profit and I've never shied away from helping the less fortunate. But I think there is something kitschy about trying to combine the two. If you want to help the poor, donate or volunteer your time. If you want to make money, have a bake sale or start freelancing (Demand Studios, eLance, Craigslist). But if you are still interested in microfinance, I encourage you to take a closer look than I have – you may find it a very rewarding venture.

Set a Goal, Let Others See

Another mode of social savings is by having a public goal. I opened up an account at SmartyPig, which is essentially a high-yield online savings account, but with a twist: your friends and family can view your progress and even contribute, if they feel like it.

With SmartyPig, you can define a goal, let's say: $20,000 for a down payment on a house, and SmartyPig will calculate how much you'll need to save each month in order to reach the goal. You can then display your progress (as a percentage, rather than a dollar figure) so your cohorts can cheer you on or hold you accountable if the number doesn't climb. In a way, it's kind of like those fundraising thermometers they put up in the middle of the town for high school drives and such. After you've achieved your goal, SmartyPig rewards you by giving you incentives with gift cards and other deals through their partners.

You should know that SmartyPig is linked to West Bank Inc., which, like all banks, is FDIC insured. The website isn't immediately up front on the issue, but that is where your money will be kept while using SmartyPig.

The service is relatively new, so you may want to read up on it before signing up. But I like the idea and have had an account for about a year with no problems.

These are just five quick and easy ideas for taking your finances digital. Inevitably, more options and solutions will crop up in the near future. Entertain these, but don't leap in immediately. As always, be wary of possible security risks and pay close attention to the murmurings on the blogosphere and in the press. Don't sign up on just one recommendation and don't rule out the unfamiliar as crazy. In the long run, keeping your finances organized by taking advantage of modern technology could save you some coin, as well as help you achieve your goals.